People around the world, though especially in Asia, talk about sovereign wealth funds as if they are the same the world over. However, there is one very significant dividing line in the type of sovereign wealth funds and it has profound implications for both economic policy and political theory.

The first sovereign wealth funds were created by oil rich Gulf states to invest their structural surplus in European and North American financial markets. By taking their long term structural current account surplus and investing foreign markets, the oil exporting Gulf states were limiting inflationary pressures and currency appreciation. So far, export focused Asian countries with sovereign wealth funds like China and Singapore have been following the same policies.

There is however one major difference between the oil rich Gulf states that first created sovereign wealth funds and the manufacturing focused east Asian states that followed in their foot steps. When an oil exporting country takes oil out of the ground, sells it, and deposits the proceeds in their sovereign wealth fund, there is no net change in wealth. Just because the oil is in the ground rather than sold with money in the bank to show for it, does not make that country any more or less wealthy. In fact, they would probably become more wealthy by keeping oil in the ground rather than selling it now.

The financial term used is that the country is “monetizing” (turning oil into money) their existing national wealth. Everyone focuses on the size of Abu Dhabi’s sovereign wealth fund, but Abu Dhabi is not any wealthier because their sovereign wealth fund has money in the bank rather than oil in the ground. A good comparison would be Bill Gates. If Bill Gates sells some of Microsoft shares turning them into cash, he is no more wealthy with cash rather than shares of Microsoft. His portfolio allocation has changed but his wealth is unchanged.

Countries like Singapore however do not have pre-existing national wealth in the form of assets like oil to turn into money. So where does Singapore get its “national wealth”? From the financial capture of the economic productivity of its population. As I have covered at length in the previous postings, Singapore has run a long term structural budget surplus but the relative enormity needs to be put into some perspective. Let me give you a a couple of ways to think about how much the government of Singapore has been “capturing” from its own population to use for its own wealth purposes.

1. From 1990 to 2012, the average government revenue to government expenditure ratio according to the IMF averaged 2.2. In words, that means that for every $1 SGD it was taking in from its people, it was only spending 45 cents! Less than half of all government revenue was actually spent on the people.

2. Consider the concept of “financial capture” or how much of the economy the government uses for its own purposes. If we add net government borrowing, government revenue, and the increase in foreign exchange reserves, the government since 1990 has on average captured 44% of GDP. This average 44% of GDP has been saved in vehicles like foreign exchange reserves, GIC, and Temasek. In other words, the government was capturing for its use and control 44% of the Singaporean economy every year since 1990.

3. It then becomes reasonable to ask how well did the Singaporean government did with that 44% of GDP the captured every year. To answer this question, let’s use a narrower definition of economic capture. Instead of using total government revenue which may include dividends and the like from Temasek or GIC, let’s use the operational government surplus representing only ongoing revenue from taxes and fees minus expenditures for government operations. From 1990 to 2010 alone, the government of Singapore captured in the form of operational government budget surpluses, foreign exchange increases, and borrowing $980 billion SGD. According to public Singapore records detailing their balance sheet and MAS reserves, Singapore controls assets of……$993 billion SGD. Given the Singapore governments 21 years of economic capture from 1990 to 2010 and their resulting assets under management, that would give them an annualized rate of return of .0007%. In other words, Singapore has returned less than 1/10th of 1% annually since 1990.

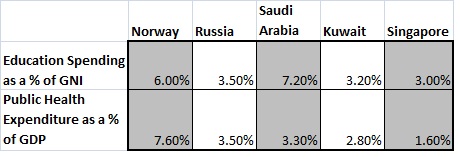

4. The enormous difference reveals itself in very real ways. While there are very real problems with excessive redistribution and a lack of entrepreneurial spirit in oil rich countries, the political philosophy of economic capture versus monetizing natural resource wealth reveals itself in how the state treats its own people. Here is a figure that illustrates the difference of how economic capture treats its people.

According to the World Development Indicators from the World Bank, when we compare Singapore to other major SWF countries with more than a few years in existence, the differences are stark. Singapore ranks last in education spending and last in public health expenditure. The government of Singapore is capturing the financial benefits of its citizens productivity and not providing the public goods and services its people have every right to expect.

Whereas oil rich states have enormous sovereign wealth funds because they won the geographic lottery, Singapore created enormous sovereign wealth funds by capturing the economic productivity of its people.

The government of Singapore has built sovereign wealth funds not through natural resource wealth or shrewd investments, but capturing the financial wealth of the people of Singapore. The people of Singapore work for the government.

Become friends with me at facebook.com/baldingsworld

very informative.

it is true that basically singapore made its monies from its people which it is now trying to stop them from taking their monies out.

questions:

1. how come you are using 900++ billion in this paper instead of the 700++ billion you mentioned in your previous paper?

2. are you sure one of singapore’s reserve purpose is to fight inflation?

1. how come you are using 900++ billion in this paper instead of the 700++ billion you mentioned in your previous paper? These are actually two different numbers. The $700 billion plus comes from the balance sheet of Singapore. The $900 billion comes from taking the $700 billion and adding the MAS reserves when converted into SGD. They are two different numbers.

2. are you sure one of singapore’s reserve purpose is to fight inflation? Actually the government of Singapore is right that its reserves are intended to flight inflation but what they don’t tell you is that it comes from a very distortionary policy. Let me explain. To keep the value of the SGD low and maintain an enormous current account surplus, MAS prints SGD to buy foreign currencies. That keeps the SGD from appreciating. However, you have now created a problem for yourself, you have printed all this SGD. If this enormous volume of SGD flows into the economy, that will absolutely create inflation. Consequently, the government has to find creative ways to sit on cash and do nothing otherwise all their printing of money to buy foreign exchange reserves will create inflation. In other words, they are correct in telling you that they are trying to prevent inflation. What they don’t tell you is that it is to solve a self created problem so they can control more wealth.

1. I thought the balance sheet number of 700 billion has already mas reserve in it? why would the balance sheet not include mas reserve?

2. if I tell you that many charges in Singapore is very high like electricity/phone etc and the producer of those services are th related firms, am I right to say that those high charges is a way to draw monies back from the public like you indicated?

1. I thought the balance sheet number of 700 billion has already mas reserve in it? why would the balance sheet not include mas reserve? No, the MAS reserves are not on the Singapore balance sheet. You’d have to ask Singapore why exactly not.

2. if I tell you that many charges in Singapore is very high like electricity/phone etc and the producer of those services are th related firms, am I right to say that those high charges is a way to draw monies back from the public like you indicated? I think that is a very true what you are saying. Who sells the land for HDB flats? What developers build HDB flats? I have seen some criticism of “free market economics” in Singapore and I am puzzled by this. We can have debates about how free markets should be, but when the government runs the market, there is nothing free about it.

btw, I notice something puzzling from what you wrote and I am not sure if I understood you right:

1. it seems like you are suggesting that sgd had been kept artificially low….

2. the part on is a bit confusing for me. For example, let say there is a big demand of sgd because of foreign currencies inflow into Singapore, printing a lot of sgd to exchange the incoming forex curriencies, and making things expensive in s’pore would get those exchanged sgd back into Singapore govt coffers?

1. it seems like you are suggesting that sgd had been kept artificially low…. I think that is an accurate assessment. Given the near 30 plus years of enormous trade surpluses and the incredibly slow and steady increase, I think it is fair to say the SGD has been kept artificially low.

2. the part on is a bit confusing for me. For example, let say there is a big demand of sgd because of foreign currencies inflow into Singapore, printing a lot of sgd to exchange the incoming forex curriencies, and making things expensive in s’pore would get those exchanged sgd back into Singapore govt coffers? Think of it this way, the trade surplus generates lots of foreign currency that needs to buy SGD. To keep the SGD from appreciating, MAS prints SGD and buys the foreign currency. Banks now have lots of SGD. If the SGD stays there, that money will make its way back into the Singaporean economy. This will cause inflation. To keep that from happening, the government and MAS come up with different ways to keep that money from hitting the economy. For instance, one example is the the Singaporean government holding at last count $125 billion SGD in cash that they just continue to add to. To put that number in perspective, Singapore could stop collecting money today and cover all its bills for more than 2 years. However, if they let that money into the economy, inflation will explode. Consequently, they have to sit on the cash. Does this explanation make sense?

Thanks Christopher for this further contribution.

We were very often told that ‘someone has to bear the cost of supporting our elderlies and raising the next generation, and not enough people are doing this, thus the massive importation of foreigners/new citizens” which has resulted in an explosive population expansion (one of highest in the world) culminating to high social discomfort and resentment these past years. It reminded me of Rome in the early BCEs where the weaknesses of letting an avaricious city determine the running of an empire would eventually help to doom it.

But I digress. What I ask is the following.

Wouldn’t it be fair to ask where is the evidence that these payments made in the past have increased (1) the birth rate (2) supporting the aged and weak members with comprehensive healthcare? Both the abysmal results to (1) & (2) have been very clear cut as your chart above rightly pointed out, in addition to the lack of cultivating its own people through education. Without a cost-benefit analysis that these payments (made conscientiously by its citizens) are doing what it is supposed to be doing ie. contribute to birth rate & well being of citizens , particularly the “right” sort of people, then the reasons for SWF or the existence of GIC/TH does not hold up.

As ever, the balance of good and bad can be titled by people and governments. History provide instances of cities succeeding and failing; of the urban goose being killed for its golden eggs and of it being force-fed so violently that it ceases to lay. I am afraid this has become the Singapore we see today.

I have not specifically considered the impact on the birth rate and supporting aged and weak members of society but yes, I think that is a fair question to ask.

if what you wrote is correct:

1. th/gic GOT its monies from the work of the people and not from investment returns,

2. the reserves values are not stress tested,

3. those monies were largely borrowed from the CPF

does it square with the fact that the govt has to charge high for medical and other public expenses i.e. no incentive for them to reduce those charges because through this mechanism, it takes back the interest and the principal from the cpf contributors that it claims it would give to these contributors?

much like the banker that was locked up in the story the count of monte cristo, where he was charges thousands for a cup of water or a loaf or bread? The banker had no choice… he was locked up.

1. th/gic GOT its monies from the work of the people and not from investment returns, Correct.

2. the reserves values are not stress tested, I would be surprised if they were stress tested.

3. those monies were largely borrowed from the CPF I wouldn’t say largely but the CPF I think has lent $180 billion SGD so not a small amount of money at all.

does it square with the fact that the govt has to charge high for medical and other public expenses i.e. no incentive for them to reduce those charges because through this mechanism, it takes back the interest and the principal from the cpf contributors that it claims it would give to these contributors? Exactly.

I think the revised borrowing number is about 380 billion sgd as the govt just borrowed another 190 billion from cpf. the debt limit ceiling was also increased at the same time.

Yes, I think the Singapore government approved an increased borrowing limit to I think $480 or even $490 billion. I need to see what the exact numbers are.

Now I understand better why it took me 13 months to have a crown installed at a subsidized price of $500 at the National Dental Centre. Luckily for me the temporary filling survived the 13-month wait.

Think part of Singapore’s reserves is made up of land which is a natural resource?

Also part of the returns from the reserves (up to 50%) is used to fund Govt expenditure (incl. healthcare and education) every year?

And altho Singapore spends less on education and healthcare as % of GDP compared to some other countries the outcomes (eg education attainment, longevity etc.) are not any poorer than these countries?

So I guess there’s more to the issue of reserves or sovereign wealth funds.

Anyway, there’s always room for improvement (social services and infra etc.) but I guess ‘capturing the financial benefits of its citizens productivity and not providing the public goods and services its people have every right to expect’ may not be very fair?

This is the track record of the Singapore Government since 1990 i.e. for 20+ years. Your “room for improvement” should have happened sooner. After 20+ years of the same mediocre treatment of its people in terms of not giving back a fair portion of the national surplus to the people and raising barrier of withdrawing CPF money for retirees, do you think the PAP will change? Ever heard of a leopard can’t change its spots?

Pingback: Daily SG: 12 June 2012 « The Singapore Daily

The govt’s policy on the printing of S$ is clear — every S$ is backed by our foreign currency reserves. Given the fact that S$ has appreciated over the years against the major currencies, (I remember well the times 1GBP=S$8.00 and 1US$=S$3.50) surely this has a negating impact on the need to print to support international trade?

Thank you for translating a lot of the intracacies of economics in layman language. As Spore’s sovereign wealth fund grows to such a monstrous size, my fear over the years is this :

1) By and by, some unscrupulous characters will come along and fritter away the national wealth. This has happened in Kuwait & Brunei and I’m sure lots of other places. History has a way of repeating itself and Spore has no haevenly immunity. The lack of transparency and the cosy blue-tie culture that exists in Spore Inc today is a guarantee to such a scenario.

2) My greater fear is more in the intricacies of economics which to my unlearned mind is probably as difficult as rocket science. There will be great minds with differing interpretations of economic statistics. You yourself have put forth your own views, no doubt some other learned minds will beg to differ (given that they have no secret agendas). There-in lies the danger — things get so complicated that key personnel may miss the trees for the wood. That’s what happened to Barings and recently JP Morgan.

1. I think you are entirely correct.

2. I think you should give yourself more credit. Part of what I want to do is educate people. I may be a Phd and write in economics, but you can understand the concepts and the problems. You may not spend as much time as I do studying the data, but you can get the big ideas. I don’t like this attitude that Singaporeans can’t understand what is going on or can’t learn.

Pingback: A very serious question that the Singapore govt should try their best to answer - is Singapore broke? «

Pingback: Leong Sze Hian » Hong Kong better than S’pore?

Pingback: baidu censor